Union Budget 2013-14 of India.Union Budget 2013-14 Highlights.Union Budget 2013-14 Live.Union Budget 2013-14 Rail.Union Budget 2013-14 pdf.Union Budget 2013-14 Income Tax.Union Budget 2013-14 Latest News.Union Budget 2013-14 Images.Union Budget 2013-14 Photos.Union Budget 2013-14 New.

"India, at the present juncture, does not have the choice between welcoming and spurning foreign investment. If I may be frank, foreign investment is an imperative. What we can do is to encourage foreign investment that is consistent with our economic objectives," he said.

Fending off 'junk'

Budget 2013: No tax slab revision, new taxes on super rich;

SUVs, mobiles costly

The government unveiled new taxes on the rich and large

companies on Thursday to fund higher-than-expected spending for the next fiscal

year, in a budget that aimed to revive growth amid the country's worst slowdown

in a decade ahead of a 2014 election.

Stocks, bond prices and therupee all fell despite finance

minister P Chidambaram's vow to cut next year's fiscal deficit to 4.8% of GDP,

which some watchers said counted on ambitious revenue assumptions given hefty

spending targets.

UNION BUDGET 2013-14 PDF FILE => => DOWNLOAD

There had been widespread expectation, fuelled in part by comments by finance ministry officials, that Chidambaram would present an austere budget in line with the spending cuts he forced on government ministries in recent months.

There had been widespread expectation, fuelled in part by comments by finance ministry officials, that Chidambaram would present an austere budget in line with the spending cuts he forced on government ministries in recent months.

But the spending plan appeared to have been drawn up with a

looming general election in mind, some economists said.

"With a general election not much than a year away,

political pressure from within the Congress Party may well have had an

influence on the make-up of the Finance Minister's budget," Credit Suisse

said.

.jpg) |

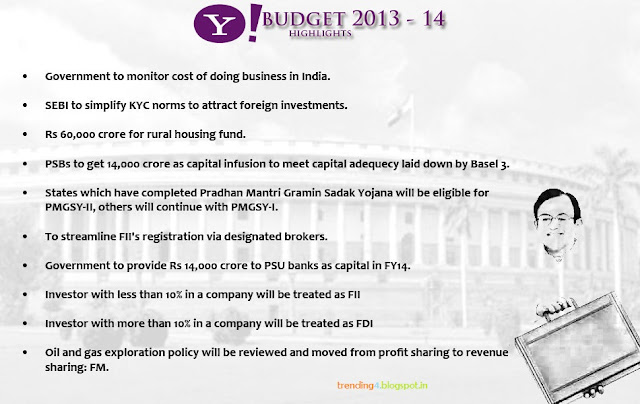

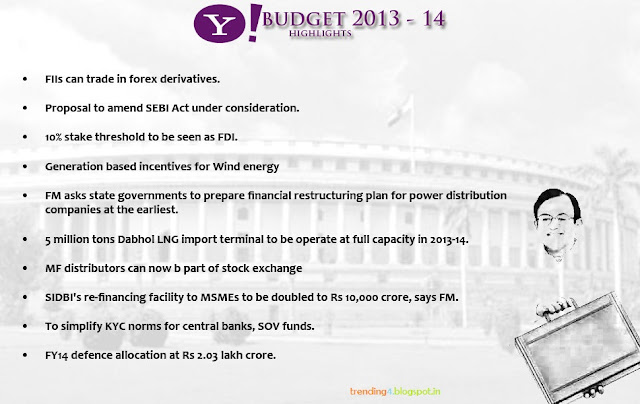

| Union Budget 2013-14 of India Highlights |

Chidambaram, a three-time finance minister seen as a

candidate for prime minister in 2014, has staked his reputation on cutting

swollen fiscal and current account deficits that have alarmed credit rating

agencies and triggered warnings that India's sovereign bonds could be

downgraded to 'junk' status. There was no immediate comment from the agencies.

"Fiscal consolidation cannot be effective only by

cutting expenditure," Chidambaram said in his speech, seen as a balancing

act to stave off a credit rating downgrade while meeting demands for populist

spending heading into an election year.

Hefty revenue growth assumptions

Total budget expenditure will rise by an unexpectedly high

16% in the 2013/14 fiscal year that begins on April 1 to 16.65 trillion rupees.

Next year's fiscal deficit target is in line with

expectations but assumes hefty revenue growth, including 558 billion rupees

from the sale of government stakes in companies, or more than double the 240

billion rupee target for the current year, which falls short of the initial

target.

"From a macro perspective, the budget is disappointing

in our opinion as it lacks any expenditure control," Nomura analysts

wrote.

The budget also assumes revenue of 408.5 billion rupees from

telecoms sector fees, more than double what it will generate this year, with

its next auction of mobile airwaves poised to flop after attracting just one

bidder.

"The government may fall short of its tax and

disinvestment targets and end up cutting spending closer to the end of the year

to attain its fiscal deficit target," said A. Prasanna, economist at ICICI

Securities Primary Dealership Ltd.

Net market borrowing of 4.84 trillion rupees for the new

fiscal year met investor hopes that

the figure would not top 5 trillion rupees, but the gross figure exceeded

expectations.

The budget included several measures to spur investment both

in markets and by corporations, including an incentive on investments in plant

and machinery exceeding 1 billion rupees and extending tax breaks for small

companies that grow larger, and an expansion of tax-free bonds for

infrastructure.

Chidambaram has focused on winning back foreign investors unnerved by proposals of his predecessor, Pranab Mukherjee, to tax merger deals retrospectively and clamp down on tax evasion. Since September, he has implemented a spate of investor-friendly reforms, including allowing entry of foreign supermarkets.

Chidambaram has focused on winning back foreign investors unnerved by proposals of his predecessor, Pranab Mukherjee, to tax merger deals retrospectively and clamp down on tax evasion. Since September, he has implemented a spate of investor-friendly reforms, including allowing entry of foreign supermarkets.

"India, at the present juncture, does not have the choice between welcoming and spurning foreign investment. If I may be frank, foreign investment is an imperative. What we can do is to encourage foreign investment that is consistent with our economic objectives," he said.

Fending off 'junk'

India's fiscal and current account deficits have alarmed

investors and ratings agencies, triggering warnings that the country's

sovereign bonds could be downgraded to 'junk' status if urgent steps are not

taken to rein in spending.

Chidambaram has staked his reputation on hitting a fiscal

deficit target of 5.3% of GDP this year and 4.8% in 2013/14.

A no-nonsense, Harvard-educated, lawyer who commands both

respect and fear in government, he squelched opposition from cabinet colleagues

worried that spending cuts could ignite a backlash among voters.

Chidambaram has focused on winning back foreign investors

unnerved by proposals of his predecessor, Pranab Mukherjee, to tax merger deals

retrospectively and clamp down on tax evasion. Since September, he has

implemented a spate of investor-friendly reforms, including allowing entry of

foreign supermarkets.

Dozens of corporate executives, watching a telecast at an

industry event, exchanged nervous smiles as Chidambaram introduced the

surcharge on the rich.

"In the larger scheme of things, I guess that is one

way of reducing his deficit. Am I going to lose sleep over it? No," Ganesh

Natarajan, CEO of IT outsourcer Zensar Technologies, told Reuters by phone.

A flagging economy left Chidambaram with little room for

big-bang populist measures without raising revenue, with economic growth for

the current fiscal year on track to hit just 5%, nearly half of what it was in

2007/08.

"This country must not lose any time - India must get

its act together to accelerate the tempo of growth," Prime Minister

Manmohan Singh said in a TV interview after the budget speech.

The budget also reflects the realities of a country of 1.2

billion people, many of them poor.

"On the one side is the economic policy, on the other

side is economic welfare. We are a developing country. The link between policy

and welfare can be expressed in a few words: Opportunities, education, skills,

jobs and income," Chidambaram said.

HT Poll:

Hey, big spender

While the added spending included capital investment that

many have said is sorely needed, including a 29% increase in funding for

infrastructure and development, it also included a 46 percent jump in funding

for development programmes in rural areas, the core voter base of the ruling

Congress party.

An added surcharge on local firms with incomes of more than

100 million rupees and a 10% surcharge on individuals with taxable incomes

topping 10 million rupees - a level of earnings currently declared by just

42,800 people - will be put in place for one year.

Dozens of corporate executives, watching a telecast at an

industry event in New Delhi, exchanged nervous smiles as Chidambaram introduced

the surcharge on the rich.

"In the larger scheme of things, I guess that is one

way of reducing his deficit. Am I going to lose sleep over it? No," Ganesh

Natarajan, CEO of IT outsourcer Zensar Technologies (ZENT.NS), said by phone

from Pune, where the company is based.

Indian economic growth for the current fiscal year is on

track to hit just 5 percent, nearly half its level in 2007/08.

"This country must not lose any time - India must get

its act together to accelerate the tempo of growth," Prime Minister

Manmohan Singh said in a TV interview after the budget speech.

The budget also reflects the realities of a country of 1.2

billion people, many of them poor. "On the one side is the economic

policy, on the other side is economic welfare. We are a developing country. The

link between policy and welfare can be expressed in a few words: Opportunities,

education, skills, jobs and income," Chidambaram said.

04:36

04:36

Unknown

Unknown

.jpg)

.jpg)

3.jpg)

.jpg)

.jpg)

.jpg)

.jpg)